Online trading platforms have been witnessing massive popularity in the last few years. The platform is today used by investors and customers across the globe due to the advantages and advanced features offered. The charges associated with these trading platforms are comparatively less. With the evolution of technology, safety and security concerns are also slowly and steadily being subsided.

The biggest advantage of the online trading platform is that it offers the convenience of trading at a time and place of your choice. There is no compulsion to go to a specific physical place to start trading, which has proven to be a huge advantage given the current situation of the Coronavirus pandemic (COVID-19).

It is very important to understand that along with advantages, there are certain things one should keep in mind before starting investing in online trading platforms. It is a wiser decision on the part of investors to choose the platform that has high reliability and good customer reviews among other things of consideration. This particular aspect can help them to have a safe trading experience without losing their money in the long term.

What Is Banxso?

Banxso is the leading player in the online trading platforms industry and it has carved a place in the competitive market by offering high-reliability safety and security to the traders. The platform offers a one-stop solution for all your trading needs and it comes as no surprise that it is becoming a favorite among the masses. It not only provides the ideal platform to trade but also guides the participants in the trading ecosystem to help them make safe and efficient trading decisions.

The approach adopted by Banxso is completely transparent and all-encompassing, which means investors need not look for any other revenue of investment in order to meet their financial goals. By offering the options of trading all kinds of assets right from Forex to stocks and from Indices to cryptocurrencies, Banxso eliminates the need for having different portfolios across different platforms for meeting the holistic need of financial investment.

Features of Banxso

Banxso is considered as a one-stop solution for all trading needs of the investors. It offers the highest level of safety and security to investors by sorting their investments into different categories. To make the experience even better, there are no hidden fees involved in the process.

Another important distinguishing factor is that the platform provides guidance on how to go through the investment in the various categories that can prove instrumental in making sure that investment targets are met within the time frame set by the investor.

It is also important to note that Banxso is committed to bring equal opportunities for all investors without any kind of bias or prejudice. It is part of the umbrella body in the investment field and it works under strict regulatory guidelines. In fact, the trading platform operates under the European guidelines and regulations, which further enhances the overall safety and security aspect related to the platform. There is no limitation associated with the experience of the investor in the field of trading as anybody can start the process by taking guidance from the experts on the platform. In addition, the platform offers education for investors that can prove really helpful in meeting the financial goal of the investors in the long run.

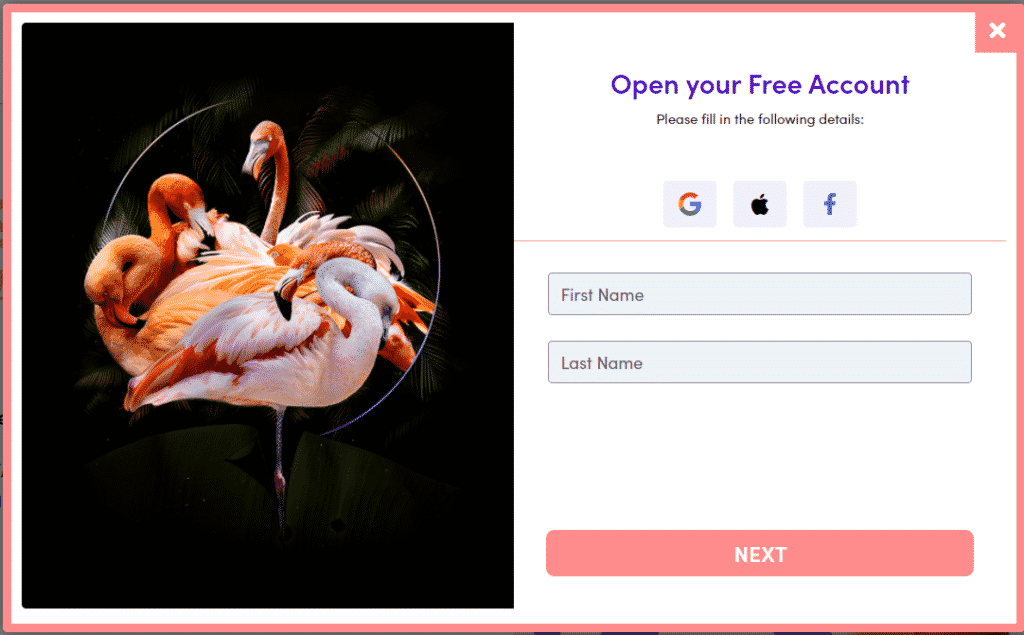

How to Open a Banxso Account?

The process of opening the account is simple. All one has to do is to go through the investment section of the platform and sign up for the Banxso account. It is free of cost, and given the simplicity of the process, investors can open the account within a matter of a few minutes. Once the signing-in is done, investors can proceed with the various decisions related to the investment.

Banxso Demo Account Service

The demo account service of the platform can be accessed by potential investors so that they get a clear idea of how to operate the account and how to go ahead with the investment decisions. It is really helpful for the investors that are new to the field of investing and still in the learning phase as far as the principles, tools, technologies, and other fundamental aspects of investing are concerned.

Types of Trading Products Offered by Banxso

The unique selling proposition of Banxso is the variety of trading products offered by the platform. Some of the significant categories in the list include:-

Forex

Foreign exchange is one of the prominent categories that can help the investors make huge profits by purchasing the currency of one country and selling it at a higher price in the other country. It is useful for meeting financial goals and with the help of Banxso, one can make attractive profits in this category.

Stocks

Investing in the stocks of different organizations is also an attractive option for making money in the financial markets. Banxso offers this option, keeping in mind the interest of the institutional investors that are eager to bet on the companies with high growth rates and robust product portfolios.

Indices

Investment in indices have also gained traction among investors. Although this option is not available on all trading platforms, the holistic approach adopted by Banxso makes the category available for investors on the trading platform.

Commodities

This is one of the most popular options among investors. Banxso offers a wide variety of trading energy commodities options to choose from in the commodity sector.

Crypto

The popularity of digital currencies is increasing by the day, which is why Banxso has included a range of options in this category to make sure investors can buy and trade digital currency of their choice.

Primarily there are two platforms offered by Banxso for the investor so that they can make investments in a productive and efficient manner:-

MetaTrader 5 comes with a range of smart tools, which offers fundamental and technical analysis tests and has the facility to send alerts to the investors in terms of the latest financial happenings in the world. It is a comprehensive platform and can be used to expand trading activities in both centralized and non-centralized markets. It is lightning fast in its operations and offers investors an opportunity to have a comprehensive view of their offers and bids across the market.

Mobile

As the name suggests, the Mobile platform allows investors to do trading and all other allied activities with the help of their mobile application. There is no need to have a desktop, as the mobile app provides you with a comprehensive set of tools that can easily accomplish all the tasks related to investment decisions. It comes as a handy option as people can trade from anywhere rather than restricting themselves to have access to the desktop for trading.

Educational Services & Investment Strategies by Banxso

In order to make sure that investors are well informed in the field of financial knowledge, Banxso offers several comprehensive educational and investment strategies for investors. This is a part of the ecosystem of the platform and it is really helpful in order to make sure that investors make the right decisions in accordance with the changing financial and business processes across the globe.

In fact, these educational services are one of the distinguishing aspects of the Banxso as there are only a handful number of platforms that actually go to the extent of providing investors with the educational services. For the newcomers and novices, this could come across as a very useful option as they can utilize the services in order to know the very basic and fundamental aspects of making an investment.

Banxso Customer Support

Unlike other customer support systems that are there only for lip service or part of the marketing strategy, Banxso offers vibrant and dynamic customer support. The entire team of the customer support system is responsive and ready to solve all the queries from the investors on a real-time basis. No matter whether your question is about the trading tools or about the specific financial market or situation arising from some emerging opportunities, you can contact the customer support system in order to get the information related to each and every trading need. The option of live chat is also available so that the queries can be handled and solved with the desired speed and efficiency.

Why Choose Banxso for Trading?

- It is one of the most comprehensive trading platforms available in the world.

- It operates under the European guidelines and has registered under the Cyprus Securities and Exchange Commission and Markets in Financial Instruments Directive.

- It offers a wide variety of financial tools to choose from.

- The option of trading from the desktop as well as mobile is available.

- The customer support system is vibrant and dynamic and helps to solve queries on a real-time basis.

- The platform also offers educational and investors awareness services that make it a comprehensive and Holistic platform.

Is Banxso Legit or Not?

As mentioned above, Banxso is registered under the Cyprus Securities and Exchange Commission and Markets in Financial Instruments Directive. This makes the platform reliable as it operates under a regulatory framework for its operations and procedures. It also takes away all the fears related to the legitimacy of the trading as it is regulated and operates under certain guidelines and recommendations of a regulatory authority.

Conclusion

Banxso is the most comprehensive and vibrant trading platform in the world of financial market investment. It comes with a range of options that make it a holistic platform to meet all your investment needs. Not only the services offered by the platform superior but also there are no hidden fees that one has to pay for investment in the financial markets. It is also regulated by guidelines, which makes it one of the safest trading platforms in the world.

It is also important to take into consideration the educational services and awareness initiatives taken by the platform. This is really unique given the fact that most of the organisations are more concerned with their profitability rather than taking a view of the customers and their investment decisions. This initiative is indeed proving helpful in order to make sure that the investors are able to achieve their financial goals with the desired efficiency.

In addition, the safety and security offered by the investment platform is also worth an appreciation as many investors are usually concerned about the legitimacy and security offered by the platforms. The algorithms, which are based on artificial Intelligence can also be counted as one of the distinctive competencies of the trading platform.

FAQs

Banxso is a genuine trading platform because unlike others it is governed by rules and regulations and has been registered under the Cyprus Securities and Exchange Commission and Markets in Financial Instruments Directive. This makes the platform a genuine and reliable one in its operations and activities.

Is There Any Hidden Fee I Have to Pay?

There is no hidden fee associated with the investment platform, which is a very positive thing given the fact that usually hidden fees are part of the charges demanded by the trading platforms.

Is the Mobile Application Available?

Banxso offers both desktop and mobile app options for investors. The mobile app is also fully equipped to carry out all the investment activities related to Financial Markets and investment decisions.

Is There Any Customer Support Available?

Banxso offers a responsive and robust customer support system to its investors. It also offers educational services so that decisions related to the investment can be made in an effective and efficient manner.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “Is Banxso a Genuine Platform?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Banxso is a genuine trading platform because unlike others it is governed by rules and regulations and has been registered under the Cyprus Securities and Exchange Commission and Markets in Financial Instruments Directive. This makes the platform a genuine and reliable one in its operations and activities.”

}

},{

“@type”: “Question”,

“name”: “Is There Any Hidden Fee I Have to Pay?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “There is no hidden fee associated with the investment platform, which is a very positive thing given the fact that usually hidden fees are part of the charges demanded by the trading platforms.”

}

},{

“@type”: “Question”,

“name”: “Is the Mobile Application Available?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Banxso offers both desktop and mobile app options for investors. The mobile app is also fully equipped to carry out all the investment activities related to Financial Markets and investment decisions.”

}

},{

“@type”: “Question”,

“name”: “Is There Any Customer Support Available?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Banxso offers a responsive and robust customer support system to its investors. It also offers educational services so that decisions related to the investment can be made in an effective and efficient manner.”

}

}]

}

bento4d

bento4d

bento4d

bento4d

bento4d

bento4d

bento4d

toto togel

situs togel

slot gacor

situs togel

toto togel

situs toto

bento4d

bento4d

bento4d

slot gacor hari ini

bento4d

slot online

bento4d

bento4d